Condo Insurance in and around Seneca

Townhome owners of Seneca, State Farm has you covered.

Cover your home, wisely

Welcome Home, Condo Owners

The life you treasure is rooted in the condo you call home. Your condo is where you take it easy, catch your breath and laugh and play. It’s where you build a life with family and friends.

Townhome owners of Seneca, State Farm has you covered.

Cover your home, wisely

Why Condo Owners In Seneca Choose State Farm

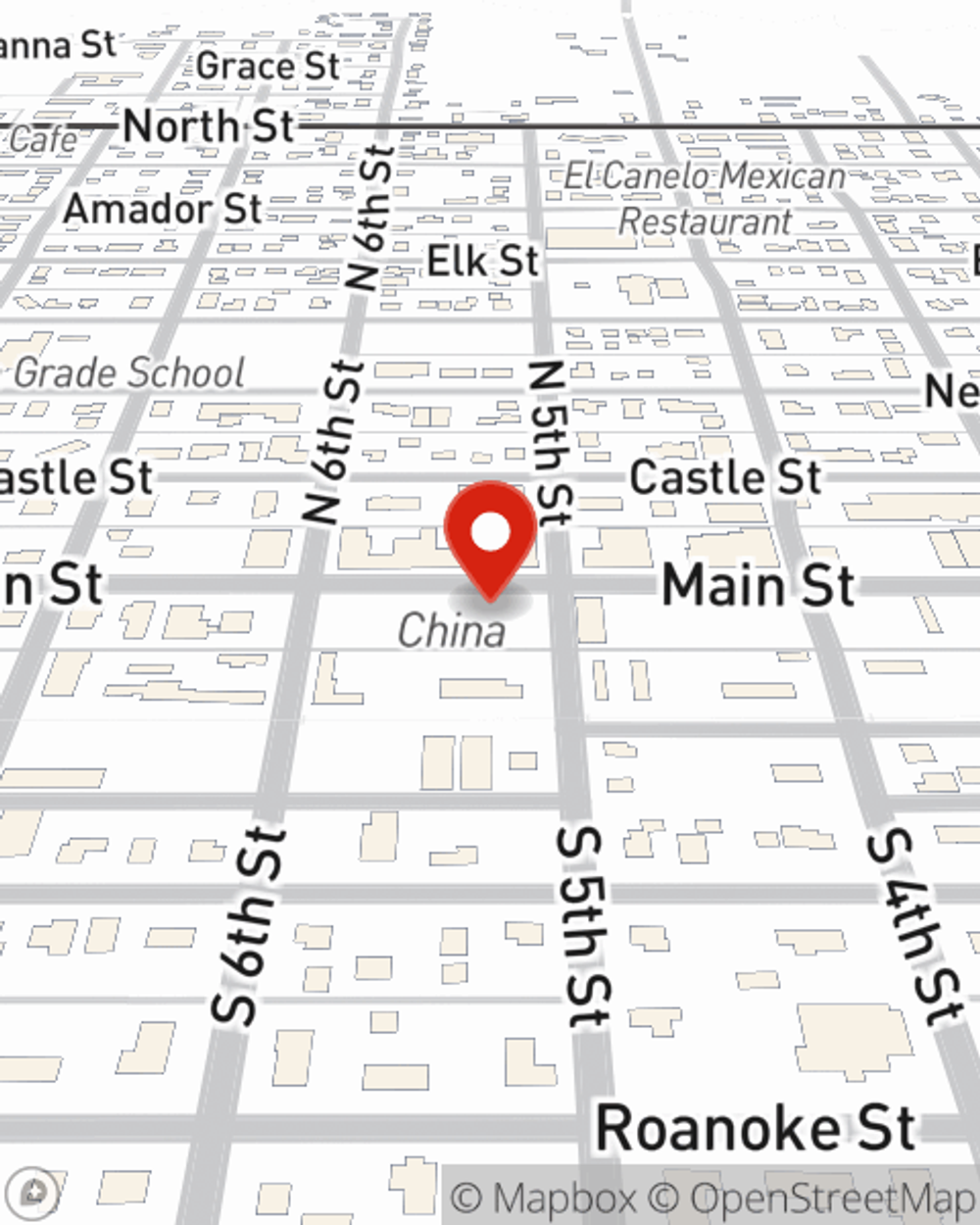

That’s why you need State Farm Condo Unitowners Insurance. Agent Tom Hilbert can roll out the welcome mat to help generate a plan for your particular situation. You’ll feel right at home with Agent Tom Hilbert, with a no-nonsense experience to get high-quality coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Tom Hilbert can help you file your claim whenever bad things happen. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Don’t let worries about your condo stress you out! Call or email State Farm Agent Tom Hilbert today and see how you can save with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Tom at (785) 336-2250 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Tom Hilbert

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.